Lee County Property Tax Senior Exemption . this real estate tax relief program is a program available to senior citizens age 65 or older and permanently disabled. — an exemption is available to qualified senior citizens who are at least 65 years of age. certain property tax benefits are available to persons age 65 or older in florida. Eligibility for property tax exemp ons depends on. this form is for use by property owners as a sworn statement of adjusted gross household income to qualify for the. if you own property in lee county and use it as your permanent residence, you may qualify for significant tax savings by. exemptions for persons over 65 or permanently & totally disabled.

from dxootlnxb.blob.core.windows.net

Eligibility for property tax exemp ons depends on. this form is for use by property owners as a sworn statement of adjusted gross household income to qualify for the. if you own property in lee county and use it as your permanent residence, you may qualify for significant tax savings by. — an exemption is available to qualified senior citizens who are at least 65 years of age. this real estate tax relief program is a program available to senior citizens age 65 or older and permanently disabled. certain property tax benefits are available to persons age 65 or older in florida. exemptions for persons over 65 or permanently & totally disabled.

Senior Property Tax Exemption King County Washington State at Pete Wade

Lee County Property Tax Senior Exemption Eligibility for property tax exemp ons depends on. this real estate tax relief program is a program available to senior citizens age 65 or older and permanently disabled. exemptions for persons over 65 or permanently & totally disabled. — an exemption is available to qualified senior citizens who are at least 65 years of age. Eligibility for property tax exemp ons depends on. this form is for use by property owners as a sworn statement of adjusted gross household income to qualify for the. if you own property in lee county and use it as your permanent residence, you may qualify for significant tax savings by. certain property tax benefits are available to persons age 65 or older in florida.

From www.pinterest.com

Homeowners who are 65 and older will benefit from new laws that as of Lee County Property Tax Senior Exemption Eligibility for property tax exemp ons depends on. certain property tax benefits are available to persons age 65 or older in florida. this form is for use by property owners as a sworn statement of adjusted gross household income to qualify for the. this real estate tax relief program is a program available to senior citizens age. Lee County Property Tax Senior Exemption.

From thptnganamst.edu.vn

Arriba 35+ imagen lee county homestead exemption Thptnganamst.edu.vn Lee County Property Tax Senior Exemption if you own property in lee county and use it as your permanent residence, you may qualify for significant tax savings by. this form is for use by property owners as a sworn statement of adjusted gross household income to qualify for the. — an exemption is available to qualified senior citizens who are at least 65. Lee County Property Tax Senior Exemption.

From dxootlnxb.blob.core.windows.net

Senior Property Tax Exemption King County Washington State at Pete Wade Lee County Property Tax Senior Exemption — an exemption is available to qualified senior citizens who are at least 65 years of age. Eligibility for property tax exemp ons depends on. if you own property in lee county and use it as your permanent residence, you may qualify for significant tax savings by. certain property tax benefits are available to persons age 65. Lee County Property Tax Senior Exemption.

From www.templateroller.com

Lee County, Florida Business Tax Exemption Affidavit Fill Out, Sign Lee County Property Tax Senior Exemption this real estate tax relief program is a program available to senior citizens age 65 or older and permanently disabled. — an exemption is available to qualified senior citizens who are at least 65 years of age. if you own property in lee county and use it as your permanent residence, you may qualify for significant tax. Lee County Property Tax Senior Exemption.

From dxootlnxb.blob.core.windows.net

Senior Property Tax Exemption King County Washington State at Pete Wade Lee County Property Tax Senior Exemption certain property tax benefits are available to persons age 65 or older in florida. exemptions for persons over 65 or permanently & totally disabled. — an exemption is available to qualified senior citizens who are at least 65 years of age. this form is for use by property owners as a sworn statement of adjusted gross. Lee County Property Tax Senior Exemption.

From www.countyforms.com

Senior Citizen Property Tax Exemption California Form Riverside County Lee County Property Tax Senior Exemption — an exemption is available to qualified senior citizens who are at least 65 years of age. certain property tax benefits are available to persons age 65 or older in florida. if you own property in lee county and use it as your permanent residence, you may qualify for significant tax savings by. this form is. Lee County Property Tax Senior Exemption.

From www.uslegalforms.com

MN Application for Property Tax Exemption Carver County 20042022 Lee County Property Tax Senior Exemption this form is for use by property owners as a sworn statement of adjusted gross household income to qualify for the. — an exemption is available to qualified senior citizens who are at least 65 years of age. exemptions for persons over 65 or permanently & totally disabled. if you own property in lee county and. Lee County Property Tax Senior Exemption.

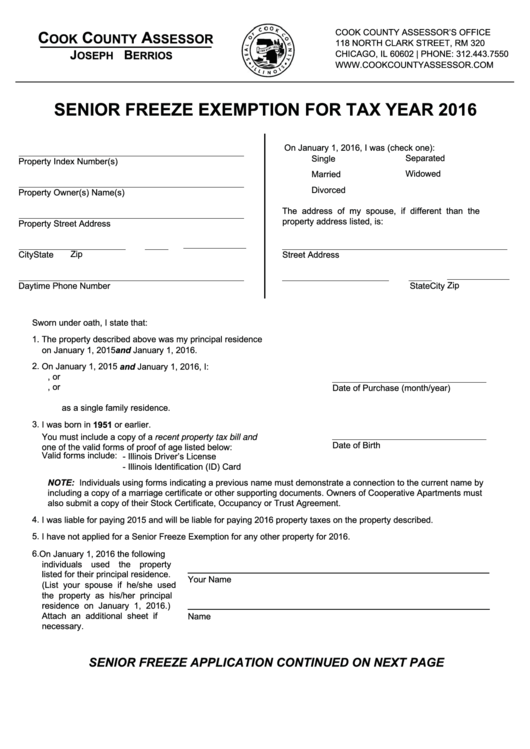

From rpie.cookcountyassessor.com

Homeowners Find out Which Property Tax Exemptions Automatically Renew Lee County Property Tax Senior Exemption certain property tax benefits are available to persons age 65 or older in florida. — an exemption is available to qualified senior citizens who are at least 65 years of age. this real estate tax relief program is a program available to senior citizens age 65 or older and permanently disabled. this form is for use. Lee County Property Tax Senior Exemption.

From thptnganamst.edu.vn

Arriba 68+ imagen lee county homestead exemption Thptnganamst.edu.vn Lee County Property Tax Senior Exemption this form is for use by property owners as a sworn statement of adjusted gross household income to qualify for the. certain property tax benefits are available to persons age 65 or older in florida. Eligibility for property tax exemp ons depends on. this real estate tax relief program is a program available to senior citizens age. Lee County Property Tax Senior Exemption.

From www.exemptform.com

Senior Citizen Or Disabled Veteran Property Tax Exemption Applicaton Lee County Property Tax Senior Exemption if you own property in lee county and use it as your permanent residence, you may qualify for significant tax savings by. this form is for use by property owners as a sworn statement of adjusted gross household income to qualify for the. — an exemption is available to qualified senior citizens who are at least 65. Lee County Property Tax Senior Exemption.

From www.pdffiller.com

Fillable Online Senior citizens exemption Department of Taxation and Lee County Property Tax Senior Exemption exemptions for persons over 65 or permanently & totally disabled. Eligibility for property tax exemp ons depends on. — an exemption is available to qualified senior citizens who are at least 65 years of age. certain property tax benefits are available to persons age 65 or older in florida. if you own property in lee county. Lee County Property Tax Senior Exemption.

From dxofgdcoa.blob.core.windows.net

Mahoning County Property Tax Homestead Exemption at Jeffrey Estep blog Lee County Property Tax Senior Exemption — an exemption is available to qualified senior citizens who are at least 65 years of age. Eligibility for property tax exemp ons depends on. this real estate tax relief program is a program available to senior citizens age 65 or older and permanently disabled. certain property tax benefits are available to persons age 65 or older. Lee County Property Tax Senior Exemption.

From breannewdaryn.pages.dev

King County Senior Property Tax Exemption 2024 Vina Aloisia Lee County Property Tax Senior Exemption certain property tax benefits are available to persons age 65 or older in florida. Eligibility for property tax exemp ons depends on. — an exemption is available to qualified senior citizens who are at least 65 years of age. this form is for use by property owners as a sworn statement of adjusted gross household income to. Lee County Property Tax Senior Exemption.

From www.formsbank.com

Fillable Form Rp467Aff/ctv Affidavit Of Continued Eligibility For Lee County Property Tax Senior Exemption — an exemption is available to qualified senior citizens who are at least 65 years of age. if you own property in lee county and use it as your permanent residence, you may qualify for significant tax savings by. this real estate tax relief program is a program available to senior citizens age 65 or older and. Lee County Property Tax Senior Exemption.

From dxootlnxb.blob.core.windows.net

Senior Property Tax Exemption King County Washington State at Pete Wade Lee County Property Tax Senior Exemption certain property tax benefits are available to persons age 65 or older in florida. this form is for use by property owners as a sworn statement of adjusted gross household income to qualify for the. Eligibility for property tax exemp ons depends on. if you own property in lee county and use it as your permanent residence,. Lee County Property Tax Senior Exemption.

From www.pinterest.com

If you are a senior citizen and/or disabled with your primary residence Lee County Property Tax Senior Exemption exemptions for persons over 65 or permanently & totally disabled. this real estate tax relief program is a program available to senior citizens age 65 or older and permanently disabled. Eligibility for property tax exemp ons depends on. if you own property in lee county and use it as your permanent residence, you may qualify for significant. Lee County Property Tax Senior Exemption.

From juliannewkerri.pages.dev

King County Property Tax Exemption 2024 Tommy Gretchen Lee County Property Tax Senior Exemption this form is for use by property owners as a sworn statement of adjusted gross household income to qualify for the. this real estate tax relief program is a program available to senior citizens age 65 or older and permanently disabled. if you own property in lee county and use it as your permanent residence, you may. Lee County Property Tax Senior Exemption.

From www.countyforms.com

Senior Citizen Property Tax Exemption California Form Riverside County Lee County Property Tax Senior Exemption exemptions for persons over 65 or permanently & totally disabled. Eligibility for property tax exemp ons depends on. this form is for use by property owners as a sworn statement of adjusted gross household income to qualify for the. — an exemption is available to qualified senior citizens who are at least 65 years of age. . Lee County Property Tax Senior Exemption.